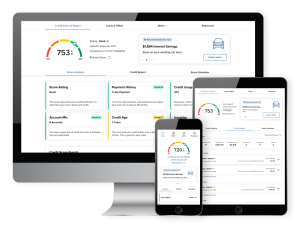

Free Credit Score Anytime, Anywhere

Our free credit score tools provide access to your real-time credit report and credit score. See special offers, monitor your credit wellness, and get on track to reach your goals.

Credit Score Tools and Features

Credit monitoring alerts

Receive email notifications when there is a change to your credit profile such as an increase or decrease in your score, credit inquiry, or new credit.

Score Simulator

Run "what if" scenarios to see how different activities can impact your score. If you paid off $5,000 on your credit card, how would that affect your credit? Find out with the Score Simulator tool.

Special offers

Get access to personalized money-saving recommendations. Applying is fast and easy within digital banking.

Daily score updates

Quickly evaluate all areas that make your credit score. Learn why your score falls where it does. Accessible anytime, anywhere within Heartland's digital banking.

Credit score goals

Create a credit score goal and action plan. View customized tips and track your progress to reach your credit goals.

Financial Checkup

What's your financial wellness score? Take the quiz to see your score and setup a custom plan based on your savings and spending budget.

See where you stand!

Heartland’s credit score tool provides free access to all the information and resources you need to understand your credit, manage it successfully, and improve your credit score if needed. Logon to digital banking and click on the Credit Score widget to get started!

You may also be interested in

Download the mobile app

The Heartland Credit Union mobile app is available on both the App Store and Google Play. Turn on automatic updates to ensure you have access to the latest features as they’re made available!

-

- Download the mobile banking app

- Register your account using the link on the sign in page

- Log in to get started

-

Browser Support

Our digital banking platform supports these browsers:

- Google Chrome (latest two versions)

- Firefox (latest two versions)

- Microsoft Edge (latest two versions)

- Safari (last two major versions or one major version if over one year old)

- Chrome for Android (last two major versions)

- Mobile Safari for iOS (last two major versions)

Device Support

Our digital banking platform supports these mobile platforms:

- Windows: versions that are still supported by Microsoft and support a browser listed above

- OSX: versions that are still supported by Apple and support a browser listed above

- Android: v8.0 and above

- iOS: the last two major releases

PDF Reader

Adobe Acrobat Reader or similar software might be required to view PDF files. You can download it here for free.

Request Mortgage Appointment

Get Code

Schedule an appointment

Virtual Appointment:

In-Branch Appointment:

File a Loan Protection Claim

Protection when it matters. We are here to help!

In your time of need, our claims process is quick and easy. If you elected payment protection on your loan, you can use this convenient claims process to quickly and easily file your claim for any of the following Payment Protection Products:

- Life

- Terminal Illness

- Accidental Dismemberment

- Hospitalization

- Family Medical Leave

- Loss of life of a Dependent

- Disability

- Involuntary Unemployment

To begin, please fill out a claim form HERE!

If you prefer, call 1.800.621.6323 to begin the process and a TruStage Claims Specialist will guide you through the process.

Leaving Our Website

You are now leaving our website and being directed to an external site. This link is provided for your convenience; however, we do not control the content, products, or services available there. We encourage you to review the site’s privacy and security policies, and terms and conditions, to ensure they meet your needs.